Financial headlines

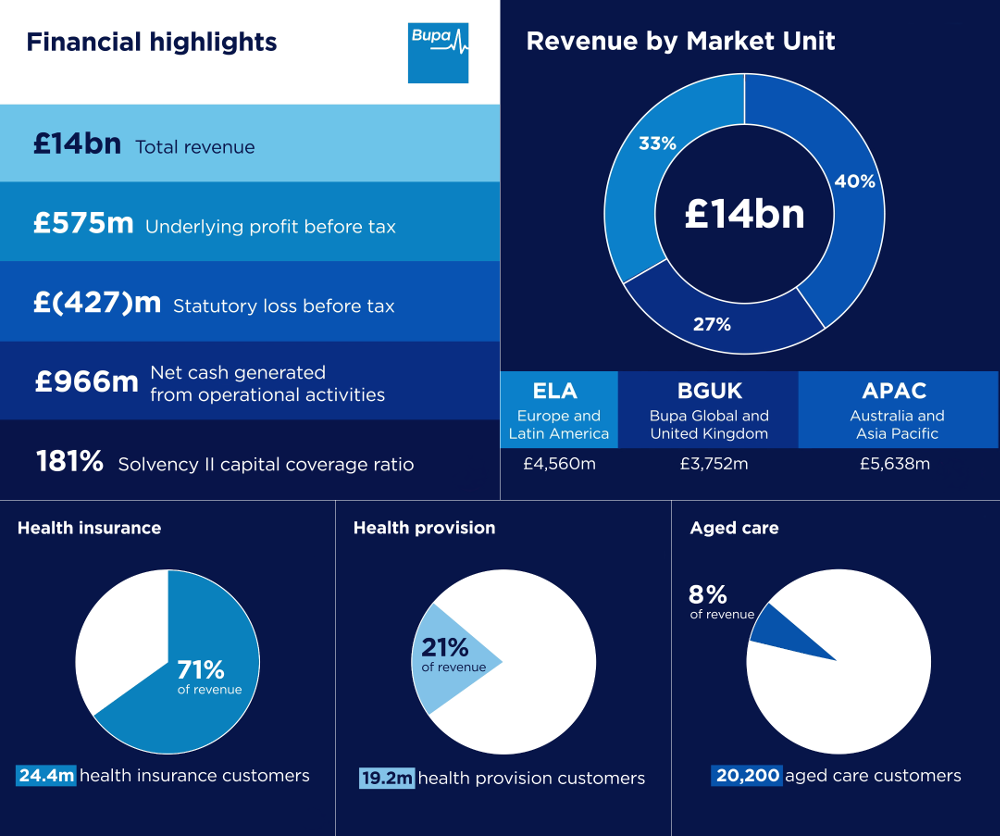

Revenue of £14.0bn was up 7% (2021: £13.1bn) at constant exchange rates (CER) with year-on-year growth in all our lines of business.

Underlying profit1 before taxation of £575m was up 43% at CER (2021: £402m) and included a number of one-off exceptional trading items in our Market Units, which are broadly neutral at a Group level.

There were asset impairments across goodwill, other intangibles and tangible assets during the second half of the year totalling £1bn. The material Business Unit impairments were UK Dental (£646m), Bupa Chile (£162m), BVAC Australia (£105m) and UK Care Services (£90m). In some cases, these were the result of macroeconomic factors and in other cases, due to market-specific dynamics which are further detailed below.

Statutory loss before taxation of £(427)m is a decline from a profit of £423m in 2021 (a 201% decline at actual exchange rates (AER)).

Continued implementation of our new 3x6 strategy drove strong customer volume growth, with one million more health insurance customers worldwide. In health provision, we grew by two million customers. Together with pricing action, these dynamics driven by customer demand offset global inflationary headwinds.

Solvency II coverage ratio2 remains strong at 181% (2021: 179%) with leverage (excluding IFRS 16 liabilities) improving to 18.5% (2021: 19.6%).

Market Unit and other Businesses underlying profit percentages are derived from reportable segments (which excludes central expenses and net interest margin). Revenues from associate businesses are excluded from reported figures. Customer numbers and economic share of post-tax profits from our associate businesses are included.

Business context

These results reflect continuing good organic growth across many of our insurance businesses and increased activity in health provision businesses to meet increasing customer demand.

These results were offset by ongoing challenges in workforce availability across several markets, particularly in UK Dental. The impacts of COVID-19 have subsided in most of our markets but persisted in parts of our Asia Pacific Market Unit.

During 2022, global inflation rose sharply resulting in higher central bank interest rates, leading to increased cost of capital which reduces the valuation of business units for impairment testing.

Iñaki Ereño, Group CEO, commented: “These results demonstrate positive underlying performance in a challenging economic environment and also reflect the rising demand for healthcare across all of our markets. We are making good progress implementing the new 3x6 strategy and we will accelerate this work through 2023 across all businesses.

"We are transforming Bupa worldwide with a focus on digitalisation and customer service, and good organic customer growth demonstrates how our customers see the value of our services, even in a cost-constrained environment.

"Significant goodwill impairments show that our businesses are not immune from macro-economic challenges and that we also have issues to fix in some businesses. We are encouraged by the quality of the growth across multiple businesses as they transform, while we continue to deliver quality and accessible healthcare for our customers."

Market performance (all at CER)

Asia Pacific: Revenue declined marginally by 1% to £5,638m, largely due to our commitment to not benefit from COVID-19 by returning cash to, and deferring premium rises for, our Australian health insurance customers. Underlying profit was £302m, an increase of 32%, and 3% after removing the impact of, as yet, undistributed health insurance COVID-19 claim savings. Improved underlying profit reflects volume growth across insurance and provision, offset by reduced occupancy in aged care, due to the localised impacts of COVID-19 and workforce availability.

Europe and Latin America: Revenue grew by 16% to £4,560m, and underlying profit increased by 40% to £233m. This included a one-off £40m Consumer Price Index (CPI) linked performance catch-up on a long-standing public private partnership (PPP) hospital contract in Spain. If excluded, the increase in underlying profit was 16%. This was driven by customer growth across most businesses and increased occupancy in Spanish aged care. This was offset by ongoing challenges affecting one of our businesses in Chile (the Isapre insurance business) which are explained in notes to the editor below.

Bupa Global and UK: Revenue was up 9% to £3,752m, due to an increase in customers across insurance and health provision, alongside improved occupancy in UK Care Services. Underlying profit declined by 58% to £25m primarily due to a one-off £117m impairment to right of use leases and fixed assets in UK Dental. There was continued customer growth and improved loss ratios in health insurance, with Bupa Global, our International Private Medical Insurance (IPMI) business, returning to profitability. This outweighed higher staff and inflationary costs pressures in health provision and aged care, alongside a shortage of clinician hours in dental.

Other businesses: Underlying profit of £58m is up 16% driven by strong underlying customer growth in our associate businesses as both the demand for private health insurance grew and these businesses emerged from the pandemic.

Financial position

- Solvency II capital coverage ratio of 181% (2021: 179%)

- Leverage ratio is 26.3% (2021: 26.9%) including IFRS 16 lease liabilities. Excluding IFRS 16 liabilities, the leverage ratio is 18.5% (2021: 19.6%)

- Net cash generated from operating activities was £966m, up £47m on prior year (2021: £919m3) primarily due to strong trading performance.

Other highlights

We continued to develop and roll-out Blua, our digital health solution, expanding it to 10 countries, including the UK.

We launched our new sustainability strategy through which we will deliver health benefits for people and planet with innovative solutions to sustainability challenges.

Through our business in Poland, LUX MED, we have been providing free healthcare support to Ukrainian refugees who have been forced to flee the war. To date, we have provided 320,000 free treatments to over 180,000 people and have employed 240 healthcare workers from Ukraine.

We became the Official Healthcare Partner to Paralympics GB and Paralympics Australia, joining our existing partnerships in Spain, Poland and Chile.

Read the Bupa Group 2022 full year financial results statement.

Notes to editor

1 Underlying profit is a non-GAAP financial measure. This means it is not comparable to other companies. Underlying profit reflects our trading performance and excludes a number of items included in statutory profit before taxation, to facilitate year-on-year comparison. These items include impairment of intangible assets and goodwill arising on business combinations, as well as market movements such as gains or losses on foreign exchange, on return-seeking assets, on property revaluations and other material items not considered part of trading performance. A reconciliation to statutory profit before taxation can be found in the notes to the consolidated financial statements.

2 The 2022 Solvency II coverage ratio is an estimate and unaudited.

3 2021 has been restated for the implementation of the IFRS Interpretations Committee agenda decision on Demand Deposits with Restrictions on Use arising from a contract with a Third Party. This has resulted in an additional £100m of restricted assets being included in cash and cash equivalents at the beginning of the year, and an additional £112m of restricted assets being included in the cash and cash equivalents at the end of the year. The movement in cash held in restricted assets line has consequently been restated by £12m from an increase of £9m to a decrease of £3m. These amounts are included in restricted assets in the Statement of Financial Position.

Note on Chile

As referenced at the Half Year 2022, the Isapre insurance industry in Chile has been negatively impacted by judicial and regulatory action1.

The Chilean Supreme Court has significantly shifted its interpretation to Isapre pricing in recent years, with the cumulative effect of restricting the previously permitted, and generally accepted, pricing/rate-setting approach. In December 2022, the Supreme Court issued a ruling which requires Isapres to use a statutory risk factor table with retrospective effect – meaning product coverage is not matched by the ability to increase rates to reflect the cost of such coverage. This ruling is complex and uncertain, and the relevant regulator has until May 2023 to implement it.

Further details regarding the financial implications of these developments are included in the Financial Review in the financial statement.

1 Isapres are part of Chile's social security system and provide access to health insurance for individuals, among other things. Pricing for Isapre contracts is determined by reference to a base price, a risk factor table (which adjusts for age) and a “GES” price (a flat rate covering a list of diseases).

Enquiries

Media

Duncan West (Corporate Affairs): [email protected]

Investors

Gareth Evans (Treasury): [email protected]

(Bupa 1025Z LN)

About Bupa

Bupa's purpose is helping people live longer, healthier, happier lives and making a better world. We are an international healthcare company serving over 43 million customers worldwide. With no shareholders, we reinvest profits into providing more and better healthcare for the benefit of current and future customers.

We directly employ around 82,0001 people, principally in the UK, Australia, Spain, Chile, Poland, New Zealand, Hong Kong SAR, Türkiye, Brazil, Mexico, the US, Middle East and Ireland. We also have associate businesses in Saudi Arabia and India.

1 Based on average number of employees during the year.

Disclaimer: Cautionary statement concerning forward-looking statements

This document may contain certain ‘forward-looking statements’. Forward-looking statements often use words such as ‘intend’, ‘aim’, ‘project’, ‘anticipate’, ‘estimate’, ‘plan’, ‘believe’, ‘expect’, ‘forecasts’, ‘may’, ‘could’, ‘should’, ‘will’, ‘continue’ or other words of similar meaning. Statements that are not historical facts, including statements about the beliefs and expectations of The British United Provident Association Limited (Bupa) and Bupa’s directors or management, are forward-looking statements. In particular, but not exclusively, these may relate to Bupa’s plans, current goals and expectations relating to future financial condition, performance and results.

By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend upon future circumstances that may or may not occur, many of which are beyond Bupa’s control and all of which are solely based on Bupa’s current beliefs and expectations about future events. These circumstances include, among others, global economic and business conditions, market-related risks such as fluctuations in interest rates and exchange rates, the policies and actions of governmental and regulatory authorities, risks arising out of health crises and pandemics, the impact of competition, the timing, impact and other uncertainties of future mergers or combinations within relevant industries.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual future condition, results, performance or achievements of Bupa or its industry to be materially different to those expressed or implied by such forward-looking statements. Recipients should not place reliance on, and are cautioned against relying on, any forward-looking statements. Except as required by any laws and regulations, Bupa expressly disclaims any obligations or undertakings to release publicly any updates or revisions to any forward-looking statements to reflect any change in the expectations of Bupa with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Forward-looking statements in this document are current only as of the date on which such statements are made. No statement in this document is intended to be a profit forecast. Neither the content of Bupa’s website nor the content of any other website accessible from hyperlinks on Bupa’s website is incorporated into, or forms part of, this document.