Information on Bupa's borrowings

Intended recipients

This section of the site is only directed to, and should only be accessed by, investment professionals (within the meaning of The Financial Services and Markets Act 2000 (Financial Promotions) Order 2005) in the United Kingdom) (“Investment Professionals”).

The information contained in this section of the site is directed at persons having professional experience in matters relating to investments. Any investment or investment activity to which such information relates will be available only to such persons and the Bupa Group will not engage with any other persons in connection therewith.

Persons who do not have professional experience in matters relating to investments should not rely on the contents of any information contained in this section of the site.

The distribution of the information or material on this section of the site may be restricted by local law or regulation. Without limitation to the foregoing, this section of the site should only be accessed by persons who are not so restricted.

No offer or solicitation and no liability

Each document contained in this section of the site is only current as at its date. Each document is provided subject to the limitations and disclaimers contained therein.

Access to the information through this section of the site is provided for informational and reference purposes only. In particular, nothing contained in this section of the site shall constitute:

- any offer of sale

- any solicitation of any offer of sale, or

- any representation, undertaking or warranty

in respect of any securities in any way.

To the extent legally permitted, and save as otherwise agreed, the Bupa Group shall not be liable to any person in any way for any damages or loss whatsoever arising out of the use of any information contained in this section of the site.

The information contained in this site is intended to be read in conjunction with, and not as a substitute for, the Bupa Group’s most recent financial statements. In the event of any inconsistency, the Bupa Group's most recent financial statements shall be considered to prevail.

Investor information

Our investor overview provides an introduction to Bupa – our history and footprint, corporate structure, overview of the healthcare market, Savannah27 strategy, our commitment to net zero and our financial strength and market unit performance.

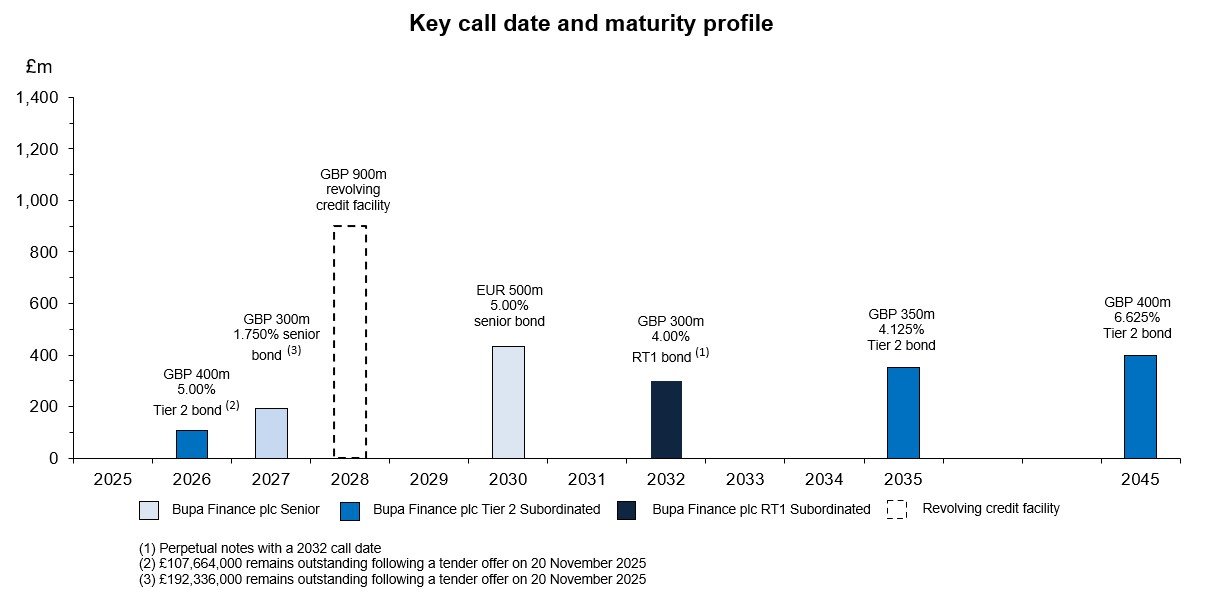

Debt maturity

Bonds

On 8 December 2016, Bupa Finance plc issued £400m of 5.00% fixed rate subordinated (Tier 2) notes with a maturity date of 8 December 2026.

On 20 November 2025 Bupa Finance plc completed a tender offer for £292,336,000 in aggregate nominal amount of the Notes. £107,664,000 in aggregate nominal amount of the Notes remain outstanding.

On 5 April 2017, Bupa Finance plc issued £300m of 2.000% fixed rate notes with a maturity date of 5 April 2024. The notes are guaranteed by The British United Provident Association Limited.

On 5 April 2024, the notes were repaid.

On 25 June 2020, Bupa Finance plc issued £300m of 1.750% fixed rate notes with a maturity date of 14 June 2027. The notes are guaranteed by The British United Provident Association Limited.

On 20 November 2025 Bupa Finance plc completed a tender offer for £107,664,000 in aggregate nominal amount of the Notes. £192,336,000 in aggregate nominal amount of the Notes remain outstanding.

Prospectus - £300m 1.750% Fixed Rate Notes due 2027

On 12 October 2023, Bupa Finance plc issued €500m of 5.00% fixed rate notes with a maturity date of 12 October 2030. The notes are guaranteed by The British United Provident Association Limited.

On 25 June 2020, Bupa Finance plc issued £350m of 4.125% fixed rate subordinated (Tier 2) notes with a maturity date of 14 June 2035.

Prospectus - £350m 4.125% Notes Due 2035

On 18 November 2025, Bupa Finance plc issued £400m of 6.625% fixed rate subordinated (Tier 2) notes with a maturity date of 18 November 2045.

Prospectus - £400m 6.625% Notes Due 2045

On 24 September 2021, Bupa Finance plc issued £300m 4.000 per cent. fixed rate reset perpetual restricted Tier 1 subordinated contingent convertible notes (the “Notes”). The Notes are subject to the terms and conditions set out in the offering circular dated 24 September 2021.

Credit ratings

| Fitch long term | Fitch short term | Fitch outlook | Moody's long term | Moody's short term | Moody's outlook | |

|---|---|---|---|---|---|---|

| £400m 5.00% subordinated (Tier 2) Notes due 2026 | BBB | - | Stable | Baa1 (hyb) | - | Stable |

| £300m 1.750% senior Notes due 2027 | A- | - | Stable | A3 | - | Stable |

| €500m 5.00% senior Notes due 2030 | A- | - | Stable | A3 | - | Stable |

| £350m 4.125% subordinated (Tier2) Notes due 2035 | BBB | - | Stable | Baa1 (hyb) | - | Stable |

| £400m 6.625% subordinated (Tier2) Notes due 2045 | BBB | - | Stable | Baa1 (hyb) | - | Stable |

| £300m 4.000% subordinated(RT1) perpetual Notes | BBB | - | Stable | Baa3 (hyb) | - | Stable |

Bank borrowings

The Group's principal bank facility is a £900m committed facility which expires in December 2028 following the second of its two optional one-year extensions. Other bank facilities may be put in place from time to time as required by the business.

Other credit ratings

| Fitch long term | Fitch short term | Fitch outlook | Moody's long term | Moody's short term | Moody's outlook | |

|---|---|---|---|---|---|---|

| Bupa Finance PLC Issuer default rating | A | F2 | Stable | - | - | - |

| Bupa Insurance Limited Issuer default rating | A | - | Stable | - | - | - |

| Bupa Insurance Limited Insurer financial strength rating | A+ | - | Stable | A1 | - | Stable |

ESG Ratings

Bupa Group engages with a number of third-party ESG rating agencies.