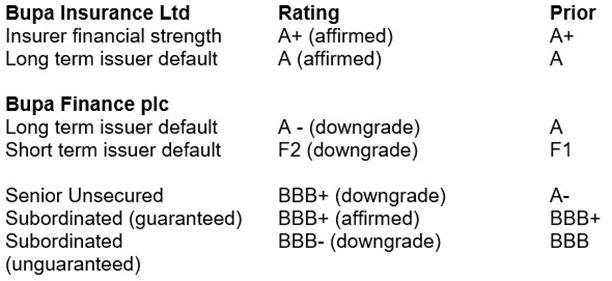

Credit rating agency Fitch Ratings has downgraded Bupa Finance plc’s Long-Term Issuer Default Rating (LT IDR) to ‘A-’ from ‘A’.

Bupa Finance plc is the main financing company, and an intermediate holding company, in The British United Provident Association Limited group (Bupa/the Bupa Group). A full list of ratings impacted is available at the end of this press release.

Fitch has also downgraded Bupa Finance plc’s senior and subordinated debt ratings, with the exception of one subordinated debt issuance whose rating has been affirmed.

Bupa Insurance Limited’s Insurer Financial Strength (IFS) rating and LT IDR have been affirmed at ‘A+’ (Strong) and ‘A’ respectively. Bupa Insurance Limited is an operating subsidiary of the Bupa Group in the UK. The outlooks on both Bupa Finance plc’s LT IDR and Bupa Insurance Limited’s IFS rating are stable.

See the full announcement from Fitch.

The Outlook on both Bupa Finance plc’s LT IDR and Bupa Insurance Limited’s IFS ratings are stable.

Notes to editor

Enquiries

Investors: Gareth Evans (Treasury): [email protected]

About Bupa

Bupa's purpose is helping people live longer, healthier, happier lives and making a better world.

We are an international healthcare company serving over 31 million customers worldwide. With no shareholders, we reinvest profits into providing more and better healthcare for the benefit of current and future customers.

We directly employ around 85,000 people, principally in the UK, Australia, Spain, Chile, Poland, New Zealand, Hong Kong SAR, Turkey, Brazil, Mexico, the US, Middle East and Ireland. We also have associate businesses in Saudi Arabia and India.